What is a Prop C full waiver?

What is a Prop C full waiver?

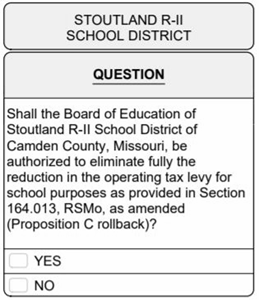

A Prop C full waiver is a proposed school operating tax levy increase to support local funding for the Stoutland School District. Our district has had a reduced (partial) Prop C waiver in place since 1994. By voting yes on April 3rd, you are voting in favor of removing the partial waiver and putting a full waiver in its place. By voting no on April 3rd, you are voting to keep the partial waiver in place. Please see a picture of the official ballot below:

How much money will the school receive with the passage of a Prop C full waiver?

Stoutland School District’s total assessed value for the 2017-2018 school year is $26,388,162. For every $100 of assessed valuation, the district currently receives $2.75 (state minimum required by law). Of that number, the district typically receives 98%, as some taxes are uncollectible.

The chart below illustrates the projected increase in revenue the district will receive if a Prop C full waiver is passed.

|

School Year |

Tax Levy per $100 assessed value |

Revenue collected at 98% rate |

|

2017-2018 |

$2.75 |

$711,161 |

|

2018-2019 |

$3.4386 |

$889,236 |

|

Projected Increase in Revenue: |

$178,075 |

|

How will the additional money generated by a Prop C full waiver be used?

Additional funding provided by the passage of a Prop C full waiver will be used to address the following needs:

- Safety and Security

- Improve safety and security equipment

- Update telecommunication and technology systems

- Repair the school building

- Academic Programs

- Enhance elementary educational programs

- Increase availability of dual credit and upper level classes

- Increase career readiness and vocational courses

- Retain highly qualified staff

How will my taxes be affected by a Prop C full waiver?

To determine the exact amount of your property tax increase, first identify the assessed value of your property. This is located at the bottom of your personal property and/or real estate taxes. Keep in mind, market value and assessed value are two different numbers.

Homes and vehicles are assessed at 19%. Land is assessed at 12%.

Some examples of how the levy increase will affect property taxes are listed below:

|

Property Type |

Assessed Value |

Potential Tax Increase* |

|

$10,000 Vehicle |

$1,900 |

$13.08/year or $1.09/month |

|

$15,000 Vehicle |

$2,850 |

$19.63/year or $1.64/month |

|

$20,000 Vehicle |

$3,800 |

$26.17/year or $2.18/month |

|

$10,000 Land |

$1,200 |

$8.26/year or $0.69/month |

|

$25,000 Land |

$3,000 |

$20.66/year or $1.72/month |

|

$50,000 Land |

$6,000 |

$41.32/year or $3.44/month |

|

$50,000 Home |

$9,500 |

$65.42/year or $5.45/month |

|

$75,000 Home |

$14,250 |

$98.13/year or $8.18/month |

|

$100,000 Home |

$19,000 |

$130.83/year or $10.90/month |

*These figures are merely examples. Exact tax amounts are available through your county collector’s office.